Tax season can feel overwhelming. Papers pile up, deadlines approach, and simple mistakes can cause money to be lost. Still, having a clear plan can reduce the pressure quickly. Knowing what to gather, how to sort it, and what to double-check makes things easier. The right steps help avoid common errors and reduce stress. A well-planned tax preparation checklist brings order and clarity.

A simple system makes filing easier, refunds arrive faster, and confidence grows with every task done. Stay organized and ahead by filing on time with the trusted support of TaxLiance Group LLC. Don’t wait until deadlines create stress—start early, get your questions answered, and take control of your taxes with guidance from experienced professionals.

Step-By-Step Tax Prep Guide

Start with one list. Then work through it in short blocks. Keep notes as you go. Also, set a weekly reminder until the filing is due. Attach every document with the help of tax preparation checklist. Then note any missing forms. Ask employers or payers for copies if needed. Therefore, nothing gets left out. Finally, set aside time to review. Small steps today prevent big headaches later.

| Category | Items to Collect | Why It Matters |

| Identity | SSNs, IDs | Prevents processing delays |

| Income | 1040X, 1120, K-1s | Reports all earnings |

| Deductions | Receipts, mortgage interest | Lowers taxable income |

| Credits | Education, child care proof | Boosts refund or cuts tax |

| Banking | Routing & account numbers | Enables direct deposit |

Must-Have Tax Documents

Most returns need standard items. Still, many people forget one or two forms, which can delay refunds. Therefore, confirm every source of income and every change in life status. Keep letters from the IRS or your state. Those notices matter. Also, track last year’s return and carryover amounts. When unsure, it’s smart to gather all documents needed for taxes and review them carefully. Missing paperwork can lead to delays or IRS notices. Having complete files ensures a smooth and accurate return.

Paperwork To Keep Handy

Think beyond income. Many items prove deductions and credits. For example, medical bills may help if they exceed limits. Likewise, student loan interest can reduce taxes. Save proof of taxes for every claim.

“Good records are the best defense against tax time stress.”

Bring receipts for donations and mileage logs. Include property tax bills and energy credit receipts. Also, add adoption, education, and child care records. Finally, note dependents’ SSNs and addresses. Label folders by year and category. That way, documents for taxes are easy to find. Organized files, speed reviews, reduced errors, and supported audits if needed.

What You Need To File

Filing rules depend on income, age, and status. For most people, wages over set limits require filing. However, self-employed workers must file if their net earnings reach low thresholds. Investment income can also require filing. Students may need to file if they worked or had unearned income.

Therefore, check tax filing requirements for your situation. Also, remember that state rules may differ from federal rules. If unsure, review the IRS Filing Thresholds chart or ask a qualified pro. Meeting the rules matters. Filing when required protects refunds and avoids penalties. Filing even when not needed can still help, especially if credits apply.

Get Ready for Tax Time

Starting early saves time. First, set up a safe folder on your computer. Next, create subfolders for income, deductions, and credits. Then scan paper records into PDFs. Name files with dates and clear labels. Also, back up to a secure drive or cloud. Meanwhile, use a simple spreadsheet to track totals. Add notes for unusual items. Schedule 30-minute review sessions each week. During one session, reconcile the bank interest. During another, check investment forms. So, prepare for tax season with focus and care. Confirm your mailing address with all payers. Clean inputs create clean returns. Small habits now prevent big delays later.

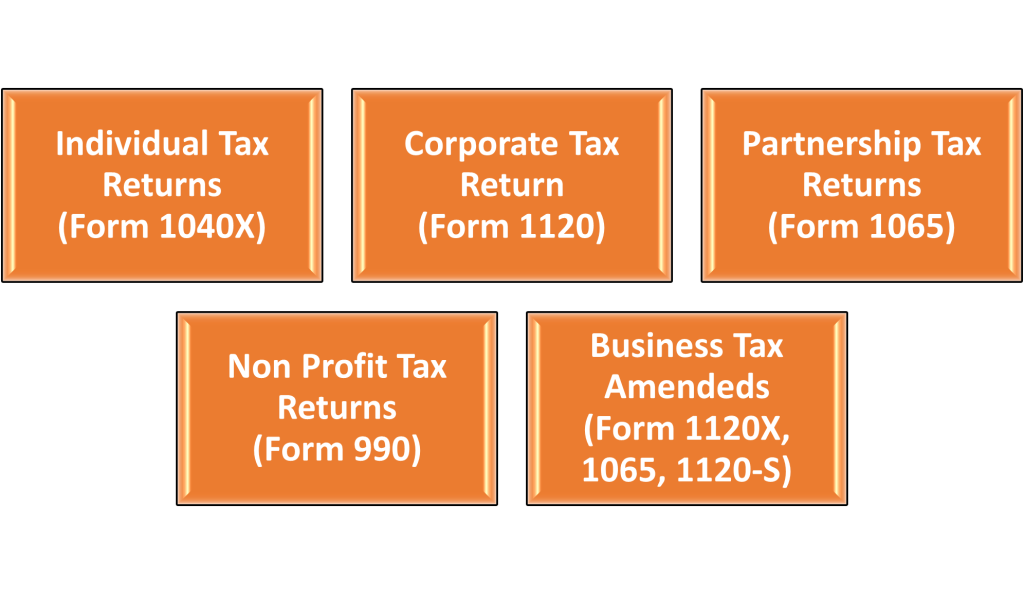

Business Tax Preparation

Small business owners have extra steps. Gather income and expense records by category. Keep bank and credit statements handy. Also, save invoices, receipts, and mileage logs. Reconcile accounts each month for accuracy. Then confirm payroll reports and sales tax filings. Include 1099s sent to contractors. In many cases, quarterly estimates apply. Therefore, plan cash flow. For location-specific help, getting business tax preparation Jacksonville FL, can support local filings by highlighting licenses, city fees, and state rules. Accurate books reduce audit risks and speed up the filing process. Clear records also support loans, grants, and growth plans.

Quick Tips:

Deductions, Credits & Expenses

Deductions reduce taxable income. Credits reduce tax directly. Therefore, both matter. Group items by type so nothing is missed. Keep proof for each claim. Add dates, amounts, and purpose. Thus, tax preparation services in Jacksonville FL, can support unique situations, including customized guidance based on individual filing needs and local requirements. Meanwhile, remember that gathering documents needed for taxes means saving receipts for every deductible expense. Also, double-check the math on all totals. Clean and accurate numbers protect refunds and help speed up processing.

Often Overlooked

- State and local tax paid

- Student loan interest

- Educator classroom expenses

- Charitable donations (with receipts)

- Medical expenses above threshold

- Child and Dependent Care Credit

- American Opportunity and Lifetime Learning Credits

- Energy-efficient home upgrades

How To Organize Your Tax Folder

A tidy folder makes filing simple. Use clear names and a steady system. Also, color-code if it helps focus. Therefore, the tax preparation Jacksonville FL can help streamline state-specific tasks by keeping local notes, contacts, due dates, and required forms neatly organized. For reference and trust, experts can help you stay organized and accurate when confidently preparing and filing your tax documents. Finally, store backups in two places. Redundancy keeps records safe.

| Folder Name | What to Store | Tip |

| 00_ID & Prior Return | IDs, SSNs, last year’s return | Keep on top |

| 10_Income | W-2s, all 1040, K-1s | Sort by payer |

| 20_Deductions | Receipts, 1098, logs | Add notes on use |

| 30_Credits | Education, child care, energy | Keep proof letters |

| 40_Banking | Void check, routing details | Verify numbers |

| 50_Notices | IRS/state letters | Scan and back up |

Make Tax Season Stress-Free

Preparation turns tax time from chaos to calm. With a clear plan, filing gets faster and cleaner. Start with a tax preparation checklist and gather items step by step. Then confirm rules, sort documents, and track totals. Next, review deductions and credits with care. These habits protect refunds and reduce audits. They also save time next year. Stay consistent, start early, and ask for help when needed. Organized records bring peace of mind. Accurate returns bring fewer surprises. With tax preparation Jacksonville FL, tax season becomes just another task—checked off and done.

Ready to file with confidence? Contact TaxLiance Group LLC for clear guidance and support throughout the process.